Blog

Brazil in Crisis: On Taxes, Temer & the Budget!

Following Dilma Roussef’s impeachment on August 31st, it is now Michel Temer’s job to confront the gripping economic crisis and corruption-riddled spectacle that has embraced Brazil.

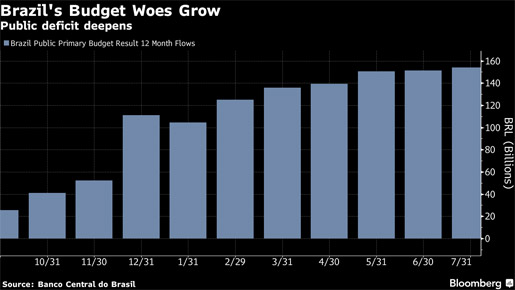

A priority on his list of to-dos is to rescue the Brazilian economy by installing a series of fiscal reforms aimed at reducing the country’s budget deficit.

In 2015, the Brazilian economy contracted by 3.8 percent, a major hit to the South American economic powerhouse, and OECD expects an additional 4.3 percent contraction for 2016.

Many, however, believe pushing for fiscal reforms will be easier said than done as the governing alliance remains fractured and will have difficulties passing the proposed initiatives.

According to Raimundo Lira, a Senior Senator with the President’s Brazilian Democratic Movement Party (PMDB), “There is no consensus within the government alliance on any of these austerity measures,” considering that “some parties want to move faster while others want to move slower and we need to find the right balance.”

Several measures are being taken into account to pave the way towards greater economic prosperity.

These include privatizations of airports, power distributors and port terminals, allowing for greater private participation in the aviation, mining and oil industry, establishing long-term limits to public spending, and reforming Brazil’s pension system, considered be my many as one of the most generous in the world.

Will Taxes Go Up in Brazil?

When it comes to taxation, however, the government has been somewhat sending mixed messages.

While Temer has announced that taxes will remain untouched, his Finance Minister Henrique Meirelles has said that additional levies might be required on a temporary basis as a last resort.

Speaking before the Chamber Representatives a couple of weeks back, Meirelles said, “Temporary taxes may be necessary,” and the country “can not discard it (increase) in the future.”

Additionally, according to the Financial Times, one of the most contentious points with regards to Temer’s budget plan to establish long-term limits to public spending is “ending rules that directly link increases in health and education expenditure to rises in tax revenue.”

Despite of this, Brazil’s Minister of Education José Mendonça Bezerra Filho announced a few weeks ago that the country’s education budget would be boosted by 7 percent in 2017.

Keep in mind that Brazil’s constitution calls for the government to spend at least 18 percent of its annual revenue on education.

Uncollected Taxes Into Securities?

One interesting tax-related proposal has emerged from all of these discussions, however.

According to a recent article in Bloomberg, there’s a plan in place to transform unpaid taxes into securities and pitching these to investors.

Per Benjamin Bain and Aline Oyamada who penned the Bloomberg article, “the plan could quickly raise as much as 70 billion reais ($22 billion) for [Brazil’s] cash-strapped government and create a new market in Brazil. If done right, the idea could catch on around the world.”

Senator Paulo Bauer, who originally proposed this model, says, “The idea is to simply anticipate revenue that would be granted anyway,” adding, “this is a very good project because the debtor will still owe to the states or the federal government.”

According to Bloomberg, here’s a good summary of how this model would work:

“Brazil’s federal government would sell about 120 billion reais of uncollected tax debts and state governments would sell about 100 billion reais, receiving the cash upfront from investors… Investors such as banks and credit managers would buy the debt at a discount of about 40 percent, while the government would still be responsible for collecting it, then paying investors. It would include debts of companies that have agreed to repayment programs.”

This unique model has been implemented in a few places like Italy and Portugal as “one-offs” that had to be shut down “due to European Union national-budget restrictions once it was determined the securities would be considered new sovereign debt.”

What are your thoughts on this plan to sell uncollected debt as securities? Maybe some of our Brazilian members care to chip in? Let us know with a comment!